In an increasingly digital world, managing money online has become a necessity for many. Skrill, a widely recognized digital wallet and payment platform, offers a convenient and secure way to handle transactions globally. But what exactly is Skrill, and why might it be a valuable tool for your financial needs? Let’s explore its features and benefits.

What Is Skrill?

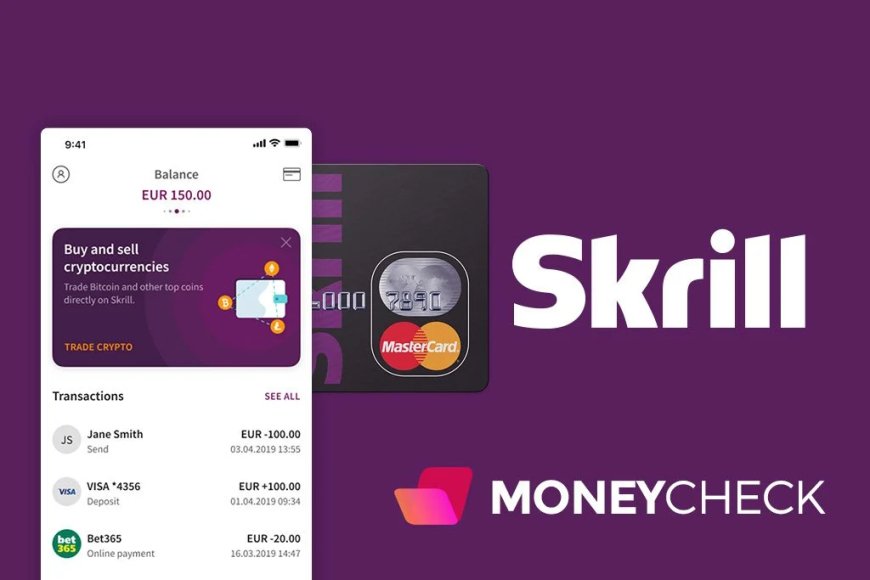

Skrill, originally launched as Moneybookers in 2001 in the UK, is an e-money service operated by Paysafe Group, the same company behind Neteller. Now headquartered in London, Skrill allows users to store funds in a digital wallet and use them for online payments, money transfers, and more. It’s not a traditional bank—it doesn’t offer loans or interest on balances—but instead acts as a intermediary for fast, secure transactions.

One of Skrill’s key offerings is its prepaid Mastercard, available to users in the European Economic Area (EEA) and select other regions. This card lets you spend your Skrill balance at physical stores or withdraw cash from ATMs. For those without the card option, funds can still be transferred to bank accounts or other payment methods, making Skrill a versatile choice for managing money across borders.

Why Use Skrill?

- Fast and Easy Transactions

Skrill is built for speed. Deposits to your account and transfers to merchants or other users are often instant, with support for multiple funding options like bank cards, wire transfers, and even local payment methods depending on your region. Whether you’re paying for online purchases or sending money to a friend, Skrill streamlines the process. - Top-Notch Security

Security is a cornerstone of Skrill’s appeal. Regulated by the UK’s Financial Conduct Authority (FCA), it follows strict e-money guidelines, keeping user funds in segregated accounts for added protection. Features like two-factor authentication (2FA), anti-fraud monitoring, and PCI-DSS compliance ensure your money and personal data stay safe. - Global Accessibility

Skrill operates in over 120 countries and supports more than 40 currencies, making it ideal for international use. You can send money to someone using just their email or phone number, even if they don’t have a Skrill account (though they’ll need to sign up to claim it). This global reach, paired with low-cost cross-border transfers, is a big draw for frequent travelers, freelancers, and expats. - Perfect for Niche Markets

Skrill is especially popular in specific industries like online gaming, forex trading, and cryptocurrency. It’s a go-to payment method for gambling sites and trading platforms, offering quick deposits and withdrawals with a layer of privacy. Additionally, Skrill’s crypto features let users buy, sell, and hold digital currencies like Bitcoin and Ethereum directly within the app. - Loyalty and VIP Perks

Skrill’s Knect loyalty program rewards users with points for transactions, which can be redeemed for cash, bonuses, or other benefits. For high-volume users, the VIP program offers lower fees, higher limits, priority support, and even a free prepaid Mastercard at top tiers, making it cost-effective for regular use.

Potential Downsides

Skrill isn’t flawless. Fees can add up—typically 1-2% for deposits and varying rates for withdrawals, depending on the method and your VIP level. Some users find customer support response times inconsistent, and account verification can occasionally be slow. It’s also unavailable in certain countries, and restrictions may apply to gambling transactions based on local regulations.

Why It’s Worth Considering

Skrill stands out as a reliable, flexible option for anyone needing a fast and secure way to manage online payments. Its strengths lie in its global reach, industry-specific utility, and robust security measures, making it a strong competitor to alternatives like PayPal or bank cards. Whether you’re an online shopper, a gamer, or a professional handling international payments, Skrill adapts to your needs with ease.

For those seeking a digital wallet that combines convenience with worldwide functionality, Skrill is a compelling choice. It’s not just about moving money—it’s about doing it smarter, safer, and faster. If that sounds like what you’re after, Skrill could be the perfect addition to your financial toolkit.

Magyar

Magyar  čeština

čeština  Polski

Polski  Slovenčina

Slovenčina